Chipmaker Intel has grown its annual revenue by nearly $20 billion in two years. Let that thought sink in for a minute.

Chipmaker Intel has grown its annual revenue by nearly $20 billion in two years. Let that thought sink in for a minute.

In 2011 it crossed the threshold of $50 billion in annual sales for the first time, having hit the $40 billion mark only last year. This came after a tough year, 2009 where sales declined a bit to $35 billion down from $37 billion in 2008. But the larger point is clear: Intel continues to be significant growth machine in a tech ecosystem that is supposed to be on the decline.

Who says so? "The experts." Earlier this month, Gartner and IDC both reported what they described as the second worst year for PC sales growth in recorded history, second only to the doldrums of 2001 when the world was beset by the dotcom crash, the onset of the global war on terror and and general recession all in one. This came after the same two outfits made similarly depressing predictions for worldwide IT spending.

Intel's results tell a different story. Consider its strengths: Sales in its data center group — chips being sold to companies building servers that will be used to power data and applications running on the Internet — grew 17 percent year-on-year to north of $10 billion. And the lowly PC? That machine that is said to be one the decline by so many people who claim to know what's going on? Sales in Intel's PC client group grew by more than $5 billion year-on-year to north of $35 billion.

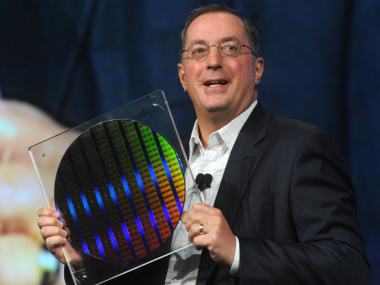

How can that be possible? It's an argument that Intel has been making for some time now and is now becoming familiar: Persistent strength in emerging markets. As Intel CEO Paul Otellini said on a conference call with analysts today, emerging markets, where household incomes are improving to the point that consumers are able to buy their first PCs, are accounting for two out of every three units of incremental microprocessor demand. That means for every three chips of new growth sold in a year, two are sold in an emerging market.

PC sales in China, by Intel's reckoning, grew 15 percent and as yes has only achieved a household penetration rate of only 35 percent, which says there's lots of room still to grow. By comparison the US market is 90 percent penetrated, meaning nearly everyone who wants a PC has one. India grew 22 percent, and Indonesia 37 percent.

Here's another really interesting metric that should give you some food for thought: Intel will in 2012 spend $12.5 billion on capital expenditures. That's more than twice what it spent last year. What is it spending so lavishly on? Four new chip factories, one in Oregon and one in Arizona, one in China and one in Israel, that will, when completed turn out chips built on the very latest, edge-of-reality technology, where chips have transistors and other elements on them that are at the 14-nanometer scale.

How small is 14 nanometers? About one-fifth the size of a typical virus cell, and only slightly bigger than the thickness of the cell wall of a typical germ. Next year there will be four factories employing thousands of people turning out thousands and later millions of these miniscule fragments of silicon that arguably constitute some of the most complex implements that mankind has ever built.

And Intel does this profitably, which is so difficult and requires such financial scale that most companies that make other kinds of chips long ago gave up running their own factories and farmed the work of actually building them to other companies. Intel is so good at it that its gross margins in 2011 were 62.5%. Its full profit for the year was nearly $13 billion on $54 billion in sales.

Yes we beat on Intel for not having conquered the smart phone industry or the tablet industry as readily as it spent the 1990s bending the PC industry to its will. There is a school of thought that Intel is less relevant today than it was say five years ago, and that its anemic presence in the future of personal computing — smart phones and tablets — is all the evidence one needs to render that judgement. In fairness smart phones and tablets are still on the rise and Intel is starting to show some promising progress, though its competition and an industry-wide preference for chips based on the ARM architecture will be difficult to dislodge.

Still, it's a little hard to find much fault with Intel when the numbers so clearly demonstrate that despite the conventional wisdom, it is clearly at the height of its powers.

Sent from my iPhone

No comments:

Post a Comment